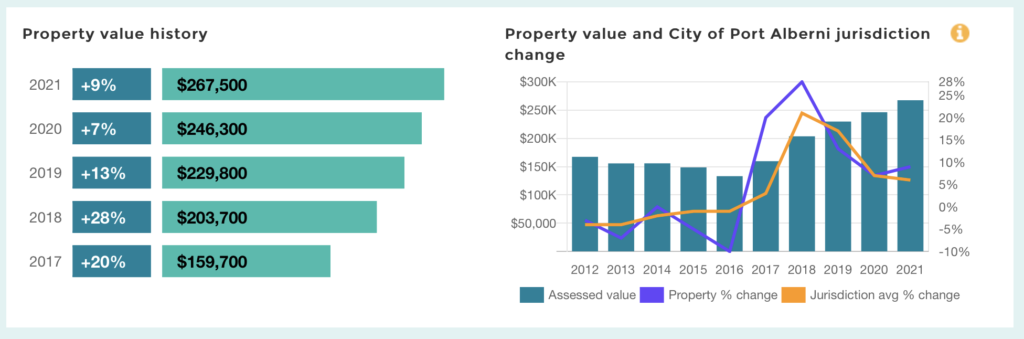

Updating the post with 2021 Numbers

I thought that instead of reinventing the wheel with a new post, I would just update this one.

Here is the current picture of my home property value.

I’ll add the updated tax amounts in the original post.

Original Post

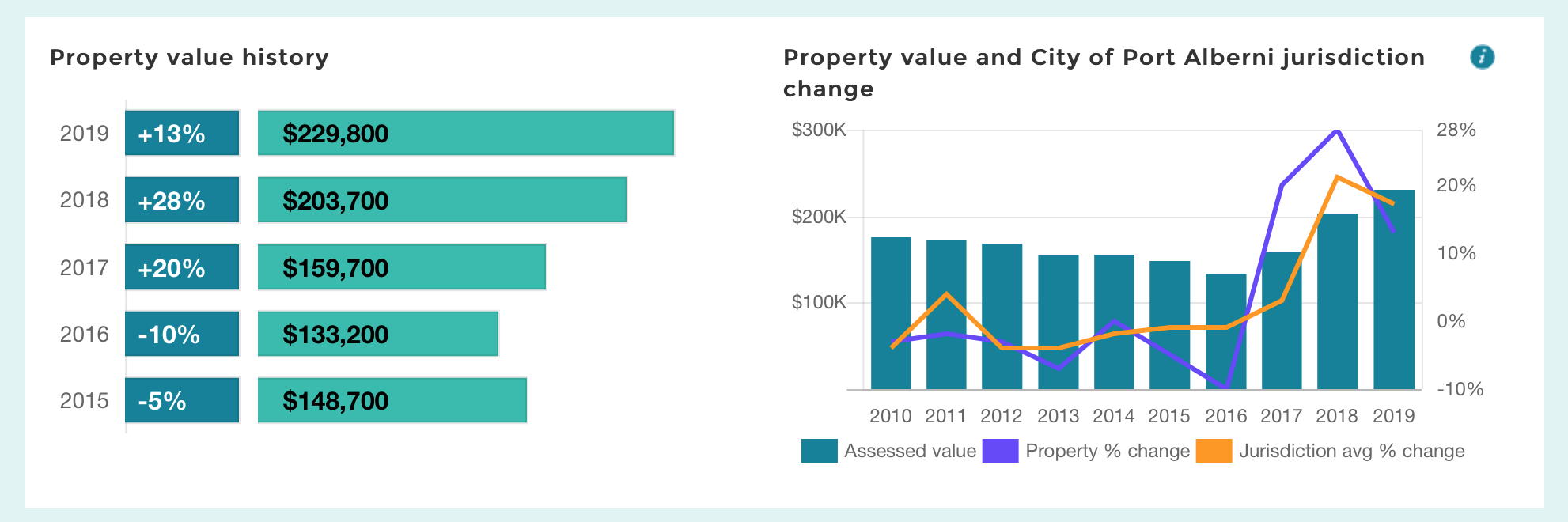

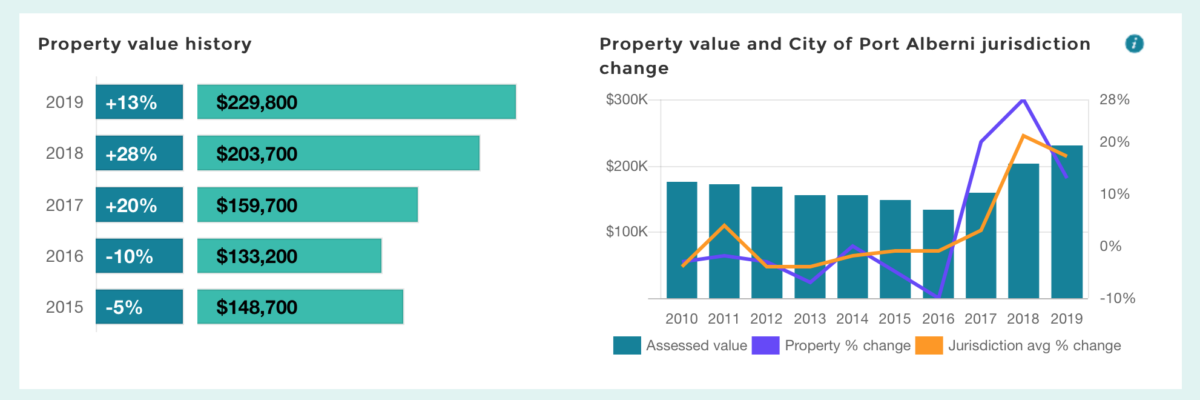

We have seen a slight cooling off (2021: It cooled off some more, even though the Real Estate market has gone bonkers, this might impact 2022) , but still pretty stunning rises in Property Assessment this New Years Day of 2019 in Port Alberni! Here’s a post about what that has actually meant for my very average home in the taxes I paid in the past 4 6 years.

Here’s what my Assessment says (3854 6th Avenue — Central Port Alberni — 2200 sqft, 1940 “Character Home” 2 floors + finished basement, standard lot.)

In the same time period, the taxes I have paid before home owner grant** and up to 2021 to the City of Port Alberni have gone like this, I’ve also included the budgeted tax increase for the City residential average for each year:

- 2021: Actual Taxes Before HOG: +0.08% ($2,271.51) City Budget: +3.95%

- 2020: Actual: +4.7% ($2,254.51) City Budget: +1.9%

- 2019: Actual: -0.05% ($2,151.81) City Budget: +3.0%

- 2018: Actual: +10.5% ($2162.78) City Budget: +3.5%

- 2017: Actual: +11.7% ($1957.87) City Budget: +2.9%

- 2016: Actual: -7.8% ($1753.67) City Budget: +2.7%

- 2015: Actual: -2.1% ($1905.55) City Budget: +3.0%

Past City of Port Alberni Financial Plans are available here and here.

Digging a little further, if you take away the non-Municipal taxes, ie: School Tax, Regional, Hospital, etc. and just use the “General” item from the tax assessment which is what the City controls* the list looks like this:

- 2021: General Municipal: -0.71% ($1,545.96) City Budget: +3.95%

- 2020: Municipal: +4.7% ($1,557.11) City Budget: +1.9%

- 2019: Municipal: -1.9% ($1,487.38) City Budget: +3.0%

- 2018: Municipal: +8.2% ($1516.81) City Budget: +3.5%

- 2017: Municipal: +9.6% ($1402.50) City Budget: +2.9%

- 2016: Municipal: -7.5% ($1279.44) City Budget: +2.7%

- 2015: Municipal: -1.5% ($1383.13) City Budget: +3.0%

The total change in assessment since 2015: +79.9% ($118,800) or on average 13.3% per year.

The change in total actual taxes paid (before HoG) since 2015: 19.2% ($365.96) or 3.2% per year

The total change in municipal taxes paid since 2015: 11.8% ($162.83) or 1.96% per year.

That’s the bottom line. In my personal estimation, while the BC Assessment increases and decreases seem very volatile and seem to make the taxes I pay swing up and down quite a bit, in the end, the average rate I pay is not rising at an unreasonable rate.

*it is worth noting the City would have some say in the “Regional” amount as a member of the Alberni Clayoquot Regional District but the “General” amount is the one that is often quoted by the press.

**I chose to do the actual taxes before home owner grant so that it is comparable to all residential taxpayers. Some of you will get the basic, some will get the larger grant, and some may even defer their taxes. Regardless, of an individual’s status with the grant, the revenue that the City of Port Alberni receives is the same.

Sources:

There is no correlation between changes in assessed value and taxes on a property. You might as well compare the cost of taxes and fireworks. The correlation is between comparative assessments between properties. i.e. if your property assessment increases above the average increase , you will see your taxes higher than the average increase. The average increase depends on the city and school budget alone. Someday people will understand multiplying ratios, but not today.

That is correct. Hopefully this post makes that point fairly obvious.

the mill rate is set by the local government and the property assessment based on market value is set by the provincial government. And it is a combination of the two that result in your property taxes. The local government should not be setting their budgets higher just because market values have gone up. It should not be looked at as an opportunity to get started on all those projects we would like to do. What will happen when property markets values decrease (as they undoubtedly will). Is the local government ready to put their jobs on the line at the voting box when they set mill rates at historically high levels for residential property to obtain the same revenue? Or will those projects have to be cut back instead? Residential Properties are carrying the commercial properties in PA and it is time that this be restrained.